The Precious Metal Market: Why 1 Ounce of Rhodium Is Worth Your Attention

The world of precious metals is vast and dynamic, with each metal offering unique properties and value. Among these, rhodium stands as one of the most expensive and sought-after metals in the market. Understanding the significance of 1 ounce of rhodium is essential for investors and enthusiasts alike, especially when considering investments in a diverse precious metals portfolio including Gold, Silver, Platinum, and Palladium Bullion for Sale.

What is Rhodium?

Rhodium is a rare, silvery-white element that is part of the platinum group of metals. It was discovered in 1803 by English chemist William Hyde Wollaston. Rhodium is not only rare but also boasts incredible reflective properties and resistance to corrosion, making it valuable for various industrial applications.

The Unique Characteristics of Rhodium

- High Reflectivity: Rhodium reflects light effectively, making it an ideal choice for optical applications and decorative finishes.

- Catalytic Properties: Rhodium is widely used in catalytic converters for vehicles, significantly helping to reduce harmful emissions.

- Corrosion Resistance: Its ability to withstand oxidation makes rhodium suitable for use in harsh environments.

- Rarity: Rhodium is one of the rarest precious metals, with annual production levels far below that of gold and silver.

The Growing Demand for Rhodium

The demand for rhodium has surged in recent years, primarily driven by the automotive industry’s need for efficient catalytic converters to meet increasingly stringent emissions regulations. This has provided a unique opportunity for investors considering the 1 ounce of rhodium as a valuable asset.

Key Industries Utilizing Rhodium

- Automotive: As mentioned, the automotive industry is the largest consumer of rhodium, utilizing it in catalytic converters.

- Jewelry: Rhodium is often used to create a durable and reflective finish on white gold jewelry.

- Aerospace: Rhodium’s high melting point and resistance to heat allow it to be used in high-performance aerospace applications.

Comparative Analysis: Rhodium vs. Other Precious Metals

When considering investments in precious metals, understanding the differences between rhodium and other metals like gold, silver, platinum, and palladium is crucial.

Rhodium vs. Gold

While gold has been valued for centuries due to its cultural significance and use as a financial reserve, rhodium offers unique benefits:

- Price Stability: Gold typically has stable prices, but it can fluctuate with economic conditions. In contrast, rhodium prices can be more volatile, reflecting immediate supply and demand dynamics.

- Investment Returns: Historically, rhodium has shown remarkable price increases, often outperforming gold during market upswings.

Rhodium vs. Silver

Silver is often more accessible to investors, but it does not possess the same industrial applications that make rhodium so valuable:

- Industrial Demand: The industrial applications for silver are broad (e.g., electronics, photography), but rhodium's role in catalytic converters and aerospace significantly boosts its demand.

- Investment Potential: Rhodium’s rising demand and limited supply can lead to greater investment appreciation compared to silver.

Rhodium vs. Platinum

Platinum is another key player in the precious metals market, often used for similar applications as rhodium:

- Catalytic Converters: Both platinum and rhodium are used in catalytic converters, yet rhodium has gained preference due to its superior catalytic efficiency.

- Market Dynamics: The price of platinum is generally lower than that of rhodium, making rhodium a more valuable investment in the automotive sector.

Rhodium vs. Palladium

Palladium is often seen as a substitute for rhodium in catalytic converters, but the two have distinct characteristics:

- Market Availability: Palladium is more abundant than rhodium, often leading to lower prices and higher availability for investors.

- Price Variability: Rhodium typically experiences more significant price fluctuations, making it a high-risk, high-reward investment.

Investing in Rhodium: What You Need to Know

For investors interested in 1 ounce of rhodium, there are several avenues to explore:

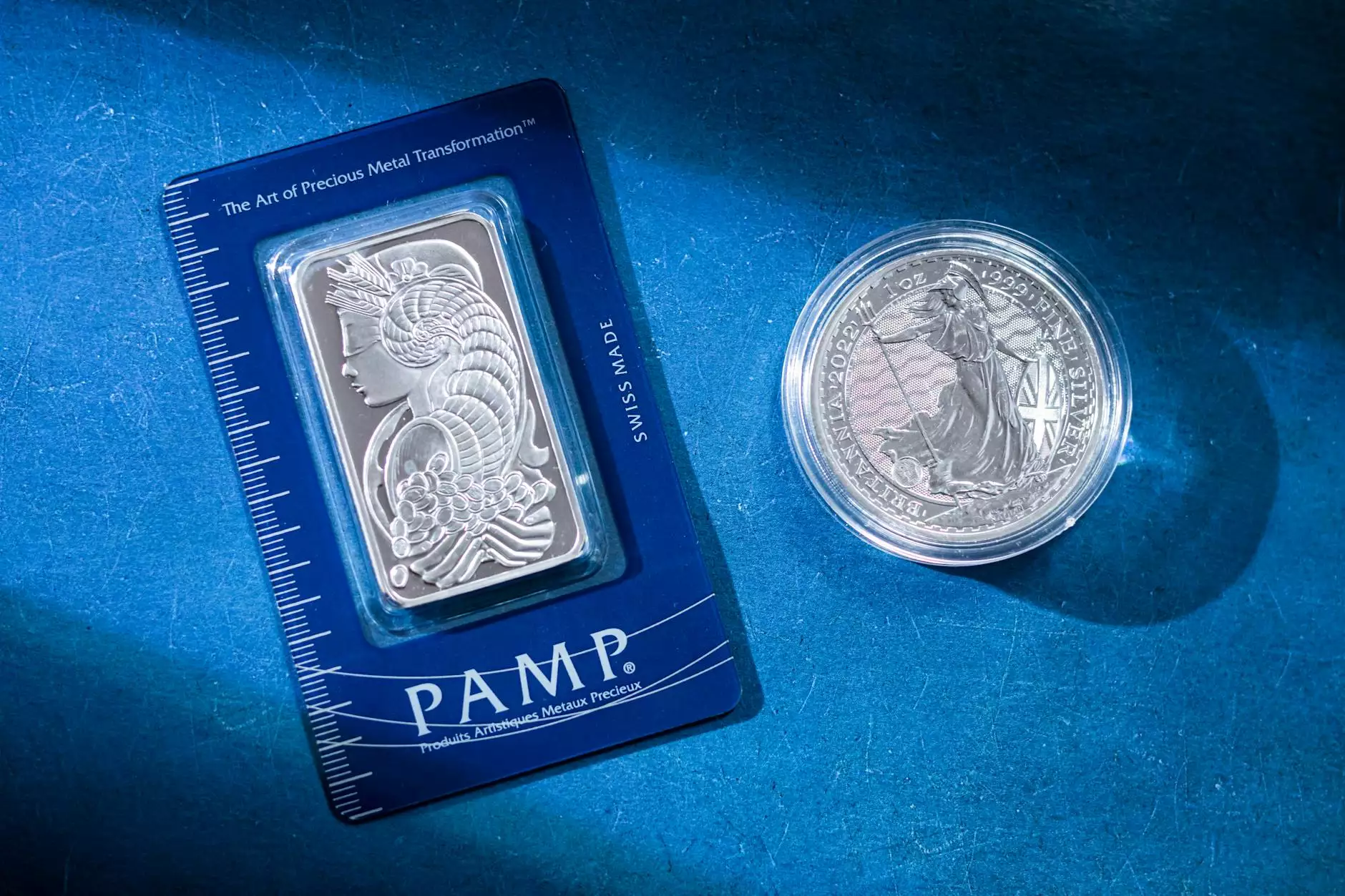

Purchasing Physical Rhodium

Investing in physical rhodium bars or coins can be an excellent way to hold this precious metal. It is essential to:

- Choose reputable dealers or platforms for your purchase, such as donsbullion.com.

- Consider the purity of the rhodium and ensure it comes with appropriate certification.

Rhodium ETFs and Investment Funds

For those preferring a less hands-on approach, Exchange-Traded Funds (ETFs) that focus on rhodium can be a viable alternative:

- ETFs offer diversified exposure to rhodium prices without the need for physical storage.

- Choose funds that accurately track rhodium prices and have a track record of performance.

Market Monitoring and Future Trends

Investing in rhodium requires more than just a decision to buy; it necessitates ongoing market monitoring. Investors should:

- Stay updated with automotive industry news, as changes in emissions regulations can impact rhodium demand.

- Monitor global economic conditions, as overall market health influences precious metals prices.

Conclusion: The Bright Future of Rhodium Investment

As the automotive industry continues to evolve and the demand for 1 ounce of rhodium remains strong, the prospects for rhodium as an investment are promising. Its unique properties, scarcity, and essential role in reducing emissions position it as a powerhouse in the precious metal market. Whether you are a seasoned investor or just starting your journey, understanding rhodium and its place among other precious metals can be the key to unlocking lucrative investment opportunities.

Ultimately, consider blending your investments in Gold, Silver, Platinum, and Palladium Bullion for Sale with 1 ounce of rhodium to maximize your asset portfolio and hedge against economic changes.